Breaking into the Top 100 of the US list, the short drama app of the former king of online literature is finally released?

Not long ago, a product called DreameShort broke into the top 100 best-selling iOS products in the United States, setting a new high in the US list in the past 30 days.

DreameShort comes from the leading online writing company Wuji System. The online writing app Dreame launched by it is among the first batch of online writing products to make achievements in overseas markets. It has also occupied the top position in the track revenue for a long time. But in the wave of online novel manufacturers attacking short dramas, Dreame is a little hesitant.

Among the major teams that are exporting short plays overseas, online content manufacturers with rich copyright resources and familiarity with overseas content have always been a force that cannot be ignored. Judging from the current situation, although Infinity is not the fastest manufacturer to turn around, it will not be until the end of 2023 DreameShort has just been launched, but it is growing rapidly.

Focusing on North America, the revenue in the past 30 days is estimated to exceed one million US dollars.

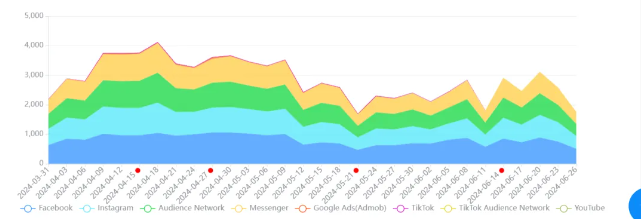

According to Diandian data, DreameShort began to generate revenue in January this year. The peak revenue occurred in April, with monthly revenue of US$1.91 million. The revenue in the last 30 days has declined slightly, to approximately US$1.02 million. The United States is the main revenue country, accounting for nearly 70%.

The two peaks on the download end were in March and April. If you look at the revenue curve, after April, when the download volume was relatively stable, revenue still saw two waves of growth, showing a good level of user retention and monetization, which was of course driven by popular products.

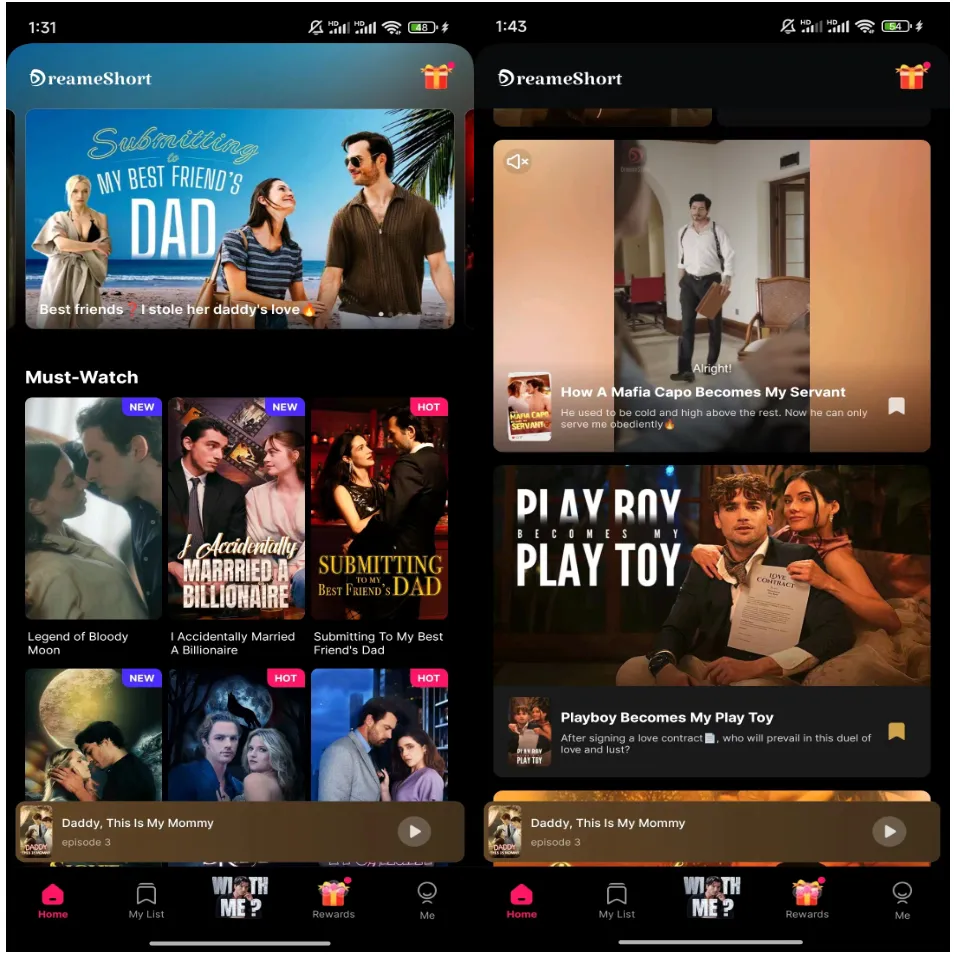

Looking at the product specifically, the design of DreamShort’s functional partitions is different from many short-series overseas products we have seen in the past. Usually everyone will create a section similar to TikTok’s short drama information flow to allow users to immerse themselves in watching short dramas, but DreameShort directly merges this function with the homepage for displaying the film library. The first half of the DreameShort homepage is still a regular film library display. If you scroll back, you can see individual short plays that are automatically played according to genre. With this design, firstly, while retaining the immersive viewing function, it appears that the film source is sufficient (after all, it is more difficult to watch to the end); more importantly, DreameShort chose to leave the “precious” functional partition to the exposure of hit short dramas .

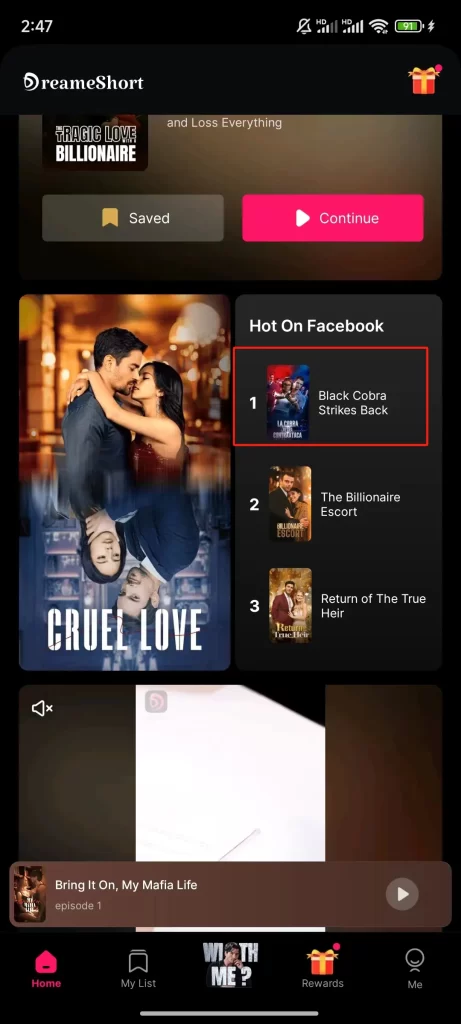

The middle tab of DreameShort is a dedicated display area for popular short dramas on the site. It is updated every day. On one day, a gangster-themed short drama called “Bring It on, My Mafia Life” was displayed. Not only did it design a special The label icon and even the page are specially created. According to TikTok for Bussiness data, popular short dramas, which account for about 2%, contribute about 79% of revenue and are well-deserved main revenue sources. The above design also shows that DreameShort can revitalize the site at a stage when the purchase volume is relatively less active. An idea of flow.

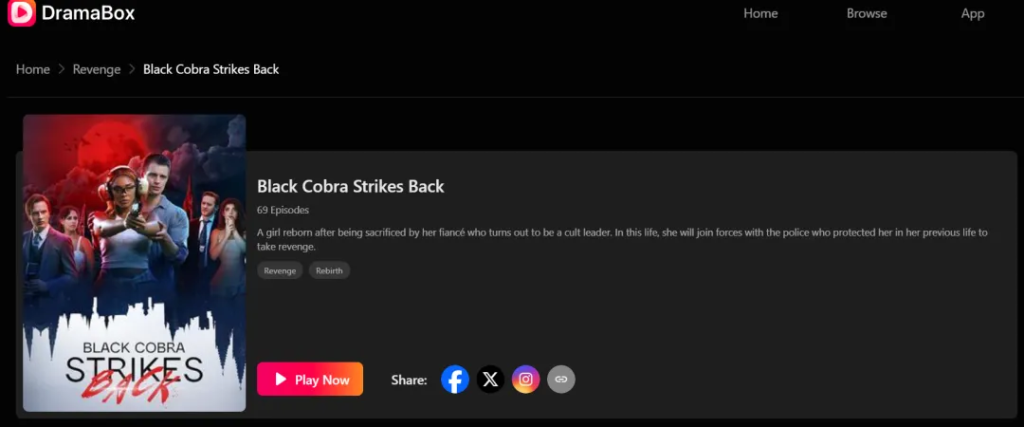

DreameShort’s currently online short dramas are all self-produced overseas female videos, roughly concentrated in several categories such as gangsters and wealthy families. Although DreameShort started a little later, it seems that the number of films has not fallen far behind competing products, mainly because it also When introducing external content, such as “Black Cobra Strikes Back” and “How I See Through You” all come from DramaBox.

Of course, a monthly turnover of one million US dollars is not actually outstanding among similar products. After all, as an old peer, Dianzhong, its DrameBox has gone straight to the first echelon. The remaining Changdu and Xinyu continue to lead in terms of revenue because they started earlier in the overseas short drama business. But judging from the trend, DreameShort has enjoyed a promising rise in recent waves, which means there is no chance to change the situation.

Can short plays not bring Dreame to life?

If we understand Infinity’s skits from the perspective of the company’s overall business development, we may see a different scene.

I still remember that when we were sorting out the online writing track in April 2022, we talked about Dreame, GoodNovel and WebNovel taking the top three revenue spots in the online writing track (see “2022 Online writing overseas has changed again: the United States can no longer move to the Middle East, China Literature ranks third? 》), and if we look back at the development trends of the above-mentioned head products in the past two years, we will find that except for GoodNovel, which has maintained its growth momentum, the revenue of the remaining two products has continued to decline.

Looking specifically at the trend in the past year, Dreame’s revenue in May this year was US$2.94 million, a year-on-year decrease of 31%. If compared to May 2022, it was a year-on-year decrease of 39%; WebNovel was closer to “flat”, once Being surpassed by MoboReader from Changdu is not consistent with the overall upward market trend of online articles going overseas.

A short drama practitioner once told us that the in-depth education of overseas short drama market has actually expanded the user scale of overseas online articles. On the manufacturer’s side, the scale of overseas online articles continues to expand, and the vast number of big data shows that in 2024, the reading product monthly The average amount of delivered materials increased by 39.56% year-on-year.

Xinyu and Changdu, which launched short dramas overseas earlier, now seem to have not missed the opportunity of the rise in the online literature market and are continuing to publish them. According to the vast number of big data, GoodNovel and MoboReader ranked Top2 and Top3 respectively in the reading application iOS launch list in April 2024. As shown in the previous data, their revenue also showed a certain upward trend.

To sum up, as an online literature manufacturer, we have done well in launching short dramas overseas early and well, and our online literature business has also grown better. But it is worth noting that after further careful observation, there is no way to say that the short drama business has driven the online article business.

Previously, we observed Maple Leaf Interactive’s operation of using short dramas to drive online content business ((see “Short plays eat meat, online articles drink soup, Reelshort takes Kiss to break into the top 30 non-game revenue”)), GoodNovel is also trying We collected another fee from the general interest group radiated by the short drama, and even created a special section for the original works of the short drama. However, considering that the influence of GoodShort is no more than that of ReelShort, it is not even as good as its own online writing business GoodNovel (Goodshort has about 42,000 daily active users in the United States). GoodNovel has twice that; Reelshort has 200,000 daily active users in the U.S., and Kiss has 1/57 of that.) This design does not seem to have a significant impact on revenue growth at present. At the same time, the use of short drama materials to buy online articles that we have previously observed does not seem to have a cost advantage at this stage, and it is rare to see online article manufacturers continue to try. Therefore, we can only judge that Xinyue did not choose All in short plays strategically, and still retained a considerable investment budget for the online article business.

As a latecomer, Dreame faced a similar situation to GoodNovel. The short drama business was not as popular as online articles, so it chose to do the opposite and directly added a short play section to the online article products. The idea was to start from the current user level. We have tried to tap users of short dramas among the larger web users, but we have not seen much feedback in terms of revenue, perhaps due to factors such as the small number of dramas (about 12 self-made dramas and 6 external short dramas).

Although the online product Dreame+ short drama has not had much spark for the time being, we also unexpectedly discovered that Wehear, the audiobook product of Infinity System, has a certain degree of discussion among the short drama user group. Some DreameShort users will spontaneously recommend Wehear, the audiobook product of Unlimited, for the simple reason that there are more tasks there that allow users to watch episodes for free.

Similar to Dreame, Wehear currently has an independent short drama section, and related free tasks are mainly designed around product promotion and growth. For example, you can receive gold coins by inviting friends to join Wehear, listening to books for a certain length of time, etc. Compared with DreameShort or Dreame are both much more generous. Considering that Wehear has the smallest number of active users among the three products, adding the “free short drama” section is most likely an idea of ”get rich first, drive wealth later”, and it does not rule out an unlimited system, which may be in the battlefield of short dramas that burn money. In addition, it is possible to bet on the audio track.

Wehear has continued to increase investment efforts in the past year, and currently has achieved at least 2 times growth in data dimensions such as downloads and active users compared to the same period last year, but its revenue contribution is not yet obvious. The addition of the new content section seems to have significantly increased the user’s stay time. Diandian data shows that Wehear’s user usage time is nearly 1 hour longer than competing products such as Pocket FM. Short dramas are responsible for Wehear’s relatively small user base. Create an effect that attracts the user’s attention.

From the revenue side, Pocket FM also focuses on entertainment content, but has chosen a less volume audio track. The main revenue market is in the United States, and Pocket FM’s commercialization achievements have also made a breakthrough in entertainment-oriented audio content. A good example, with monthly sales of US$470,000, and official data is that the product’s ARR has exceeded US$15 million.

At last

In terms of business volume, the current main business of Infinite System and Xinyue is still online writing. From a strategic point of view, short plays must be done overseas. However, short plays have already been rolled up overseas, which is expensive and difficult to be “for”. For the second echelon of short dramas, cost is the biggest consideration for the important task of attracting traffic through online articles; for Dianzhong and Maple Leaf Interactive, the short drama business has really taken off, and short dramas can finally empower the upstream content business. , but after seeing the ceiling of tens of millions of dollars in monthly revenue for short drama apps, it seems that it is even harder to be impressed by the traditional online writing business. Under the premise of limited resources and limited window period, making short plays or web articles really requires choosing sides to some extent, and the decision-making may need to be more decisive.

Practitioners have told us that there are obviously more market opportunities for online articles going overseas this year. Not only has the development of overseas short dramas brought about a new round of prosperity for overseas online writing, but at the same time, some leading manufacturers have tilted their resources towards the short drama business, leaving more room for small and medium-sized manufacturers to survive. The threshold for Internet writers to go overseas is low, and newcomers can quickly fill their positions. If the position is lost and the short drama business is difficult to break through, the situation may be very embarrassing.