With the rapid increase in the penetration rate of global Internet and other infrastructure and smartphones and other terminals, the number of global “netizens” has increased significantly. And “emerging markets” with a large and young population base and low economic development levels but fast growth have naturally become the vanguard of this “wave”, generating a large number of incremental users. Among them, the Middle East, where users have a relatively strong ability to pay, and Southeast Asia, which is geographically close, especially the latter, became the first choice for overseas manufacturers a few years ago.

However, in practice, people’s original perception that the market is vast and filled with money-making opportunities and that cultural differences are not significant has been shattered by reality.

Opportunities in Southeast Asia belong more to large manufacturers. This is a conclusion reached by overseas companies after a period of exploration. For example, when Byte launched the overseas version of Doubao Cici, it first chose the Southeast Asian market in order to focus on user growth first. . For small and medium-sized developers who need to generate revenue in the short term and achieve a positive ROI, they will naturally choose high ARPU markets such as Japan, South Korea, Europe and the United States where it is easier to generate revenue. Therefore, judging from the overall data, after a wave of enthusiasm, developers have become cautious about going overseas to emerging markets.

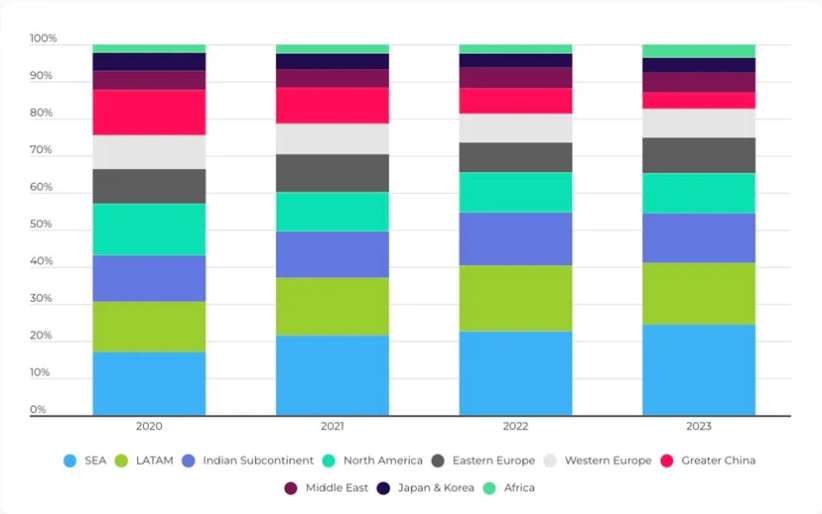

Trend of installation volume of Chinese mobile game APPs in overseas destinations from 2020 to 2023

According to this chart of the proportion of Chinese mobile game downloads in various global markets over the years, we can see that in 2021, the proportion of mobile game installations in Southeast Asia has increased significantly, with a year-on-year increase of 4.57%. Latin America and other emerging markets The market also rose, but installations in the North American market fell by 3.11%. In 2022, the growth in Southeast Asia’s market share will drop sharply to less than 1%. At the same time, the decline in other markets is not so obvious.

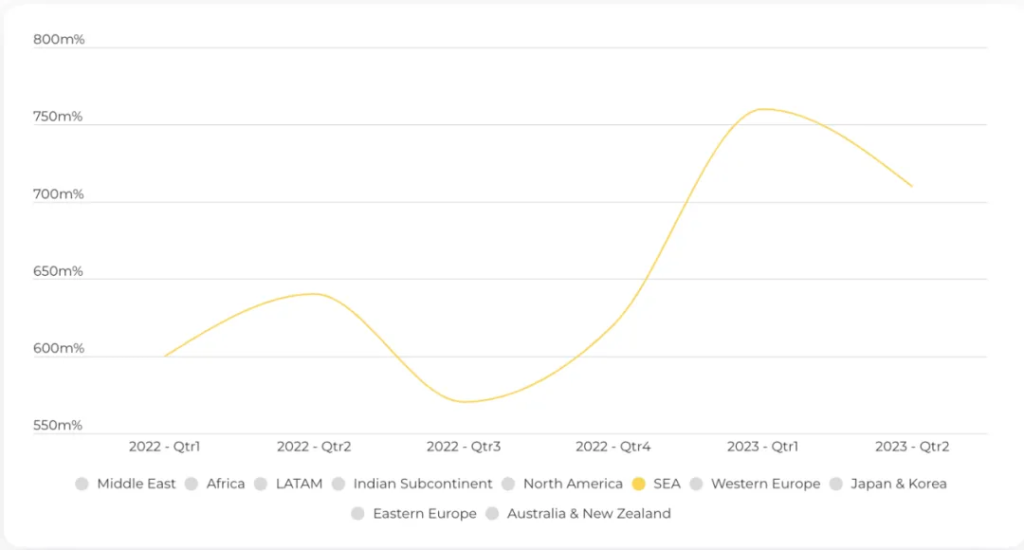

But in the past two years, things seem to have changed. TikTok has achieved a certain penetration rate in various markets after going overseas for many years. In addition, after starting e-commerce monetization, it has brought many business opportunities, and Southeast Asia has become a top priority. At the same time, digital payments have become rapidly popular in Southeast Asia in recent years. Nowadays, various infrastructures such as marketing, monetization, and logistics are constantly improving. Coupled with the intensifying geopolitical risks in Europe and the United States, emerging markets have begun to be taken seriously by some manufacturers, especially The Southeast Asian and Middle Eastern markets are booming again.

In Southeast Asia, we have observed that recently there have been some products from non-big manufacturers that can generate good revenue. For example, the Three Kingdoms mecha-themed game “X-Samkok” launched by 4399 has generated revenue of US$4.4 million in the past 30 days. The top five revenue markets are in Southeast Asia except the United States.

But realistically speaking, for ordinary developers, it is still relatively difficult to make income in emerging markets, and due to the increase in the number of developers entering emerging markets, emerging markets are gradually becoming more popular. According to AppsFlyer data, the CPI of overseas mobile games (Cost per Install) will jump in 2023, with an increase of around 20%.

Rapid penetration of hardware, supplementing new growth channels

On October 10, 2024, vivo held its 2024 Developer Conference and announced a series of new changes and initiatives in overseas distribution, covering application promotion, traffic innovation and localization, etc., which can provide developers in emerging markets overseas with Match users more accurately and solve the problem of difficulty in acquiring customers.

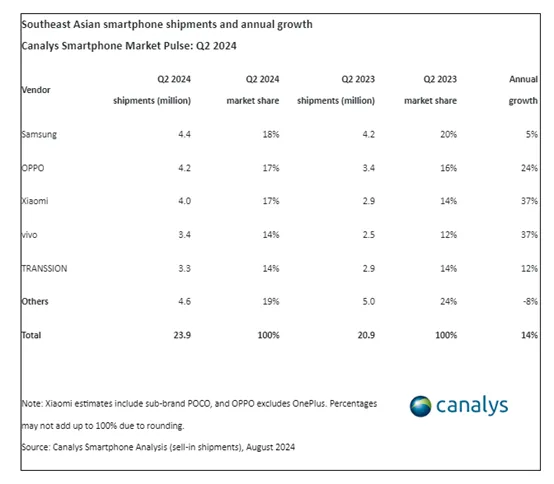

Southeast Asia Q2 2024 Mobile phone shipment ranking | Image source: Canalys

As one of the earliest domestic mobile phone brands to go overseas, vivo has been deeply involved in emerging markets for many years. In the past three years, vivo’s cumulative shipments in South Asia have reached 81.79 million units, and in Southeast Asia, cumulative shipments have also reached 35.5 million units, with a market share of 16.6%. According to the mobile phone shipment data in Southeast Asia for the second quarter of 2024 given by Canalys, vivo reached 3.4 million units, a year-on-year increase of 37%, firmly occupying the fourth place. In addition to South Asia and Southeast Asia, vivo will start to focus on the Middle East market in 2022, and has also achieved good results in the United Arab Emirates and Saudi Arabia, and its market share is still growing rapidly.

The application store installed on mobile terminals is the most direct scenario for mobile developers to reach target users. As the shipments of mobile phones and other hardware increase, the data of its application store V-Appstore has also increased significantly. As of now, V-Appstore has 230 million online users, 140 million MAU, 25.45 million DAU, and average daily distribution volume of 28.03 million, a year-on-year increase of 20%. By continuously serving a large group of active users, vivo has accumulated a lot of operating experience in overseas markets and established a full-chain closed loop from application services to commercialization, which can help users find better apps and developers. Efficiently acquire, convert, and monetize customers.

The more volume the market has, the higher the value of “accuracy”

In 2024, as going overseas has become a “business right”, various markets are gradually becoming more volume. To really generate revenue from a product and achieve a positive ROI, not only does the product need to be “excellent” but also find suitable users. In addition, all manufacturers must also find their own way to reduce cost losses. Among them, user growth is the most costly link and also has a lot of room for optimization.

In response to the pain points of developers, vivo’s answer this year is “accurate”.

- Integration of multi-scene exposure resources,Help developers find the most suitable users

First of all, this year, V-Appstore focused its update on resource integration, realizing the collaborative linkage of vivo family buckets, opening up global distribution outlets, and reaching users more comprehensively. In the future, not only V-AppStore, but also system applications such as browsers, global search, iButler, Yitu Lock Screen, and Game Center will be integrated and distributed through various methods such as negative screen, Push notification, and desktop folders. App. Different distribution outlets have their own advantages. By expanding the distribution outlets, vivo can help developers obtain traffic more flexibly and accurately.

In addition to reaching users in all directions, the accuracy of target users is also crucial. Therefore, in addition to expanding diversified distribution outlets, vivo is also further optimizing user tags, app store design and application updates. First of all, vivo will conduct in-depth analysis of multi-dimensional data such as user behavior, preferences, life cycle, and traffic channels, and combine multi-scenario data to conduct full-scenario joint modeling to accurately control user needs and increase app conversion.

At the app store level, vivo has also optimized the functions and visual effects of monthly recommendations, application details pages, and added rich visual effects and interactive designs. These new effects can increase the application conversion rate by 70%+ and the application conversion rate by 50%+. Single application click-through rate. At the application update level, V-Appstore will also provide developers with more protection. Through measures such as major version update notifications and algorithm-level exposure weighting of major new versions, the update coverage of major versions will be improved, and inactive users will be targeted through updates. recall.

2. Multi-level localization to build precise marketing scenarios

Localization is a commonplace issue, and when developers mention localization, they focus more on product design and routine operations, but in fact, localization is also key to growth. Appearing in front of the right users at the right time is also a kind of “precision”.

Localization is a commonplace issue, and when developers mention localization, they focus more on product design and routine operations, but in fact, localization is also key to growth. Appearing in front of the right users at the right time is also a kind of ” precision”.

In addition to the comprehensive upgrade of local activities, vivo also launched an exclusive cooperation event with developers this year, providing exclusive benefits such as exclusive discounts, application/version launches, and application featured modules.

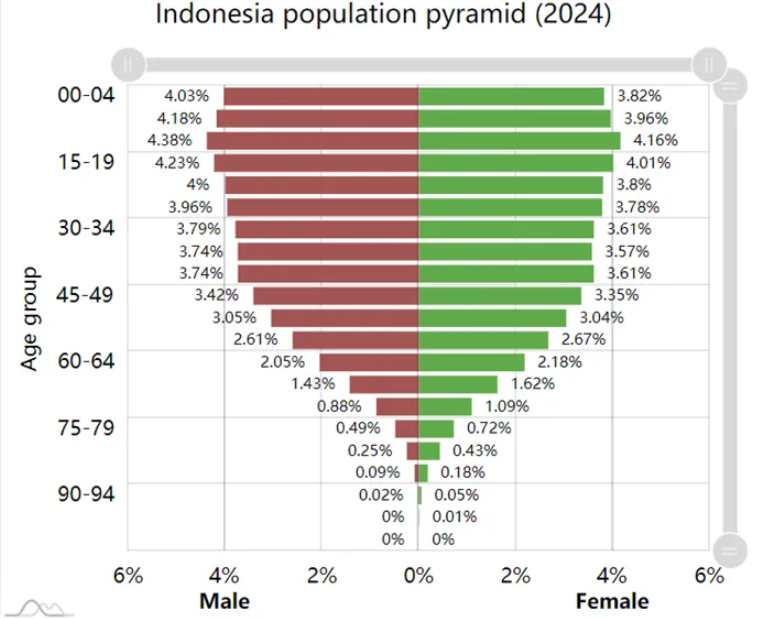

Indonesia has a high proportion of children under the age of 15

Localization not only tests the growth team’s insight into a region’s culture, but also tests its ability to capture changes in local society and find new business opportunities.

Vivo, as an overseas manufacturer, understands the importance of this, so V-Appstore launched a new exploration in thematic content area this year. Taking Indonesian data as an example, Indonesia’s birth rate in 2023 is 16‰, far exceeding that of domestic and European and American regions. In the entire Southeast Asia region, there are still several countries with high birth rates. Therefore, based on market insights, the vivo operation team tried to set up a children’s area that meets the needs of Southeast Asian users. It gathered a number of well-known overseas education brand apps in the children’s area, integrated the original scattered exposure resources, and optimized them through manual assistance. , to achieve children’s application download and conversion improvement. Subsequently, vivo launched many partitions with distinctive characteristics of the region, which also received good results.

3. Precision lies in required quantity, but more importantly in quality.

In fact, no matter what kind of plan, for developers, it is ultimately measured by ROI. For developers, during the delivery process, bidding, clicks, conversion rate, and conversion cost are all closely linked. To address these issues , vivo has launched a series of measures to improve the amount and quality of App activations.

In terms of activation volume, in addition to expanding the traffic matrix, vivo has also optimized traffic support, refined bidding at different locations, etc., to reduce developers’ delivery costs and improve delivery efficiency through more detailed intervention. In terms of activation quality, vivo has formed an optimization strategy of “traffic/crowd + bidding strategy”. Specifically, in the early stage, it will be targeted to some “traffic/population”, and samples will be accumulated at a controllable cost. When the samples are sufficient, the bidding strategy will be optimized, and the bid will be dynamically adjusted based on the estimated conversion rate of each user to achieve the overall effect. After stabilization, cancel the orientation.

If we take the earliest batch of tool apps going overseas as the starting point, it has been more than ten years since the mobile Internet went overseas. TikTok, Kwai, Genshin Impact, MLBB and other Chinese products with global influence have emerged. In this process , the growth has long ago changed from the barbaric growth that can make profits, to today’s refinement. Although it is more complicated, it is a sign that the development of an industry has entered a more mature and formal stage. Those who make good use of tools and do a good job in digitalization , companies that understand precise marketing and operations may be able to achieve better results in overseas markets.